They have carved a niche for themselves in the Indian banking industry; but it just seems that they’re about to break free and takeover the Indian market like never before. by Deepak Ranjan Patra

May 25, 2010 was a landmark day, not only for Indian stock market or banking sector, but also for all foreign companies operating in India. Standard Chartered Plc opened an Indian Depository Receipts (IDRs) for subscription on this day. So what’s the big deal? It’s the first IDR in India by any international company in the history of India’s existence! Before you break into a diplomatic applause, the fact is that Stanchart (if we may) is not spectacularly huge currently. Consider this – the IDR issue is for a bank, which has just 90 offices, 7,825 employees, and a top line of Rs.19 billion in India. And yet, it is aspiring to raise Rs.33.75 billion from the market! But for every critic, there’re ten supporters, and vociferous ones. One obviously being Peter Sands, Group Chief Executive, Standard Chartered, who says, “Standard Chartered was established in India over 150 years ago, and this heritage is vitally important to us as we continue to grow our market visibility and brand presence in one of our largest markets. I am immensely proud that it is Standard Chartered listing the first ever IDR.” Honestly, Stanchart is not the only one in the league. Over the last few years, bosses of many global banking giants operating in India, if not all, have developed a similar business confidence over their Indian operations. After all, despite being paralysed by our regulatory controls and restricted to just 300 branches (March 2009), the 30 foreign banks control 5% market share in terms of deposits as compared to 95% controlled by all other banks through 64,028 branches, showcasing 10 times higher efficiency. However, there too exists a strong line of demarcation, as the top 5 foreign banks – HSBC, Standard Chartered, Citi, Deustche Bank and RBS – control 82.7% of the total market share enjoyed by the foreign banks. Even their profit margins are far better than the industry average for the last few years.

Going by what industry experts have to say, it’s just the three words – technology, innovation and quality service. Prashant Singh from Royal Sundaram shares with us, “As the outreach is enlarged in the India banking industry, with the increased number of banks and wider network, the customer demands convenience, comfort, speed, cost- effective and quality services.”

While foreign banks outpaced their Indian peers on all parameters including loans, deposits & CASA, their credit related activities took a beating, thanks to the downturn Unlike their volume-driven Indian counterparts, foreign banks in India have been predominantly characterised by their limited presence across the nation. As on June 2009, 32 foreign banks comprising 293 branches, constituted a mere 0.5% of the total branch network. Riding on the competitive edge spelt by the use of high-end technology, a customer-centric approach and innovative, diverse product offerings, these banks have typically set shores in metropolitan regions (almost 80% as compared to 35% new Indian private banks, 20% old private banks & 20% PSU banks). But the restricted spread has in no way limited the prospects for these players who have registered steady growth on all parameters. Despite the 0.5% share of the network, the market share stands at an impressive 6%. The 32 foreign banks cumulatively accounted for 5.5% of total system advances, 5.3% of system deposits, 18% of operating profit and 14% of system net profit in FY09. This is commendable given the low penetration. This is largely the result of an improving economic environment and pick-up in credit activities. In contrast, the major factor that has adversely affected the foreign banks is their concentration on the retail segment, which was truly down and out during the downturn of the global financial crisis. The consequence is obvious – their loan book went up by a mere 3% while the Indian private counterparts saw a 12% rise during the same period. While the strong branding, better customer service & product innovation initially helped them make strong inroads into retail & SME lending, the resultant book seasoning turned a large part of these loans into NPLs, thereby resulting in higher provisioning & deterioration in asset quality. The balance sheet story has been pretty obvious. While foreign banks outpaced its Indian peers (PSU & private banks) on all parameters including loans, deposits & CASA, the credit related activities took a beating, thanks to the downturn. For more articles, Click on IIPM Article.Source : IIPM Editorial, 2010. An Initiative of IIPM, Malay Chaudhuri and Arindam chaudhuri ( Renowned Management Guru and Economist). For More IIPM Info, Visit below mentioned IIPM articles.

IIPM B-School Detail

IIPM makes business education truly global

IIPM’s Management Consulting Arm - Planman Consulting

Arindam Chaudhuri (IIPM Dean) – ‘Every human being is a diamond’

Arindam Chaudhuri – Everything is not in our hands

Planman Technologies – IT Solutions at your finger tips

Planman Consulting

Arindam Chaudhuri's Portfolio - he is at his candid best by Society Magazine

IIPM ranked No 1 B-School in India

domain-b.com : IIPM ranked ahead of IIMs

IIPM: Management Education India

Prof. Rajita Chaudhuri's Website---------------------------------------------------------------------------------------------------------------

India needs to be abreast of the global environment in the banking arena; convenience at banking has to be given prime importance These are the times where we are witnessing path breaking innovations supported by technology and entrepreneurship approach in almost all walks of life. So be it in field of telecommunications, the way cricket is viewed and perceived, or be it the banking & financial industry. Banking no longer is viewed as a stable and hence a non-innovative field, things have changed a lot over the last 15 years. That the ‘Customer is King’ truly holds good with the banking sector as well. Gone are the times when one had to walk into a branch to get their passbook updated, now customers have the delivery by pressing a few buttons on his mobile or their laptops. The concept that a customer does not walk into a bank branch but the bank comes to the customer is reality now – doorstep banking where banks reach out to the customer for cash/remittance transactions is a ‘must have’ product. Ease of transacting has become basic to banking – hence withdrawing from any bank’s ATM or receiving instant messages on your mobile on any transaction in your account or daily wealth portfolio movement and stock market updates are offered by any bank now. These are the times that India needs to be abreast with the global environment in the banking arena thus convenience at banking has to be given prime importance – thus, banking truly comes under the ‘service’ segment. All new service channels are evolving, making things easier for the customer; but the ‘branch’ continues to be in existence and is a popular banking channel for transactions. Thus, innovations in branch banking are also evolving. Extended servicing hours, open on holidays/Sundays, premium servicing lounge are customer expectations in addition to non-branch delivery channels. Customers now have ample choice, not just within banks but within segments of banks – foreign, private sector or public sector banks. While customers approach various types of banks depending on their requirements, the key to maintaining and increasing market shares by any bank is to customise themselves to customer needs. For more articles, Click on IIPM Article.Source : IIPM Editorial, 2010. An Initiative of IIPM, Malay Chaudhuri and Arindam chaudhuri ( Renowned Management Guru and Economist). For More IIPM Info, Visit below mentioned IIPM articles.

IIPM B-School Detail

IIPM makes business education truly global

IIPM’s Management Consulting Arm - Planman Consulting

Arindam Chaudhuri (IIPM Dean) – ‘Every human being is a diamond’

Arindam Chaudhuri – Everything is not in our hands

Planman Technologies – IT Solutions at your finger tips

Planman Consulting

Arindam Chaudhuri's Portfolio - he is at his candid best by Society Magazine

IIPM ranked No 1 B-School in India

domain-b.com : IIPM ranked ahead of IIMs

IIPM: Management Education India

Prof. Rajita Chaudhuri's Website

---------------------------------------------------------------------------------------------------------------

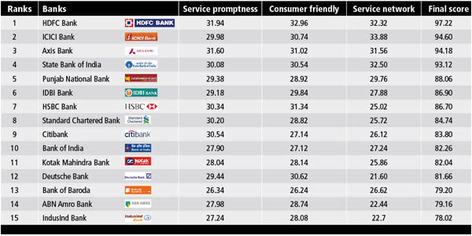

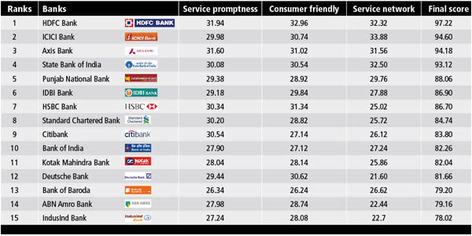

Slowdown, market crash, and an uncertain banking environment, yet some banks find their way to make it to the top of the consumers’ minds. 4Ps B&M with ICMR finds those victorious banks that managed to break on through to the other side... India’s best marketed banks!

Best Marketed Banks In India (ICMR and 4Ps B&M Rankings)

Based on consumers’ perception about the banks that form a part of their everyday life

They have managed to befriend the local dealers and are offering them greater margins, a proposition that players like Nokia have missed out on. So does that imply the end of Nokia’s rule? Some ground it has lost, but even today has a market share of 54.1% (IDC report for 2009) – that is some dominance! Going forward, Nokia is gearing up to fight back, evidence of the same being the new launches in the lower-price range. To prevent further erosion in the feature-rich phones category, the company has launched three QWERTY pad handsets – Nokia C3, Nokia C6 & Nokia E5 – that are attractively priced between Rs.5,317 to Rs.13,000. There is also the Nokia X2, a music phone with a 5MP camera, which is being offered at a price of Rs.5,000. justifying the launches, Anssi Vanjoki, Executive VP, Nokia says, “There are reactive elements in the new launches, but this is more of a strategic move. We have always looked to offer a full range of products and services to our consumers and are continuing with that.” Call it a defensive shot or a forward ball to bowl out the threat from new entrants, Nokia is a seasoned veteran, who has been through much more in the Indian market and worldwide. It still enjoys a reputation of an aspirational brand that offers reliable products and as long as it can keep its hands off product recalls, it will continue to hold the sceptre over the isle known as the Indian mobile market. Surbhi ChawlaFor more articles, Click on IIPM Article.Source : IIPM Editorial, 2010. An Initiative of IIPM, Malay Chaudhuri and Arindam chaudhuri ( Renowned Management Guru and Economist). For More IIPM Info, Visit below mentioned IIPM articles.

IIPM B-School Detail

IIPM makes business education truly global

IIPM’s Management Consulting Arm - Planman Consulting

Arindam Chaudhuri (IIPM Dean) – ‘Every human being is a diamond’

Arindam Chaudhuri – Everything is not in our hands

Planman Technologies – IT Solutions at your finger tips

Planman Consulting

Arindam Chaudhuri's Portfolio - he is at his candid best by Society Magazine

IIPM ranked No 1 B-School in India

domain-b.com : IIPM ranked ahead of IIMs

IIPM: Management Education India

Prof. Rajita Chaudhuri's Website---------------------------------------------------------------------------------------------------------------

In order to connect with a large number of customers, the National Stock Exchange (NSE) has taken to advertise on rail. Initiated on April 28, 2010, NSE campaigns for investor awareness will run on Rajdhani trains on three routes viz. Delhi-Chennai, Delhi-Bangalore and Delhi-Trivandrum. The coaches of these trains will have colorful images of NSE’s flagship index Nifty and other products like mutual funds and gold ETFs. Apart from the advertisements on the outside, the passengers inside the coaches of the trains will be provided with pamphlets and audio visual material that will spread awareness about the dos and donts of the financial markets. Speaking about the campaign, Ravi Narain, CEO and MD, NSE said, “NSE has been conducting financial investor awareness programme for the last several years. This initiative is financial literacy on wheels wherein audio visual information (literature) will be made available on long distance trains.” Avneesh SinghFor more articles, Click on IIPM Article.Source : IIPM Editorial, 2010. An Initiative of IIPM, Malay Chaudhuri and Arindam chaudhuri ( Renowned Management Guru and Economist). For More IIPM Info, Visit below mentioned IIPM articles.

IIPM B-School Detail

IIPM makes business education truly global

IIPM’s Management Consulting Arm - Planman Consulting

Arindam Chaudhuri (IIPM Dean) – ‘Every human being is a diamond’

Arindam Chaudhuri – Everything is not in our hands

Planman Technologies – IT Solutions at your finger tips

Planman Consulting

Arindam Chaudhuri's Portfolio - he is at his candid best by Society Magazine

IIPM ranked No 1 B-School in India

domain-b.com : IIPM ranked ahead of IIMs

IIPM: Management Education India

Prof. Rajita Chaudhuri's Website---------------------------------------------------------------------------------------------------------------

Well, the dope is that 9X, the general entertainment channel (GEC) of media house INX, is being targeted by Zee Entertainment Enterprises Ltd (ZEEL), currently India’s largest media company. Apparently, the board of directors of Zee has approved the said deal. ZEEL has apparently kept aside Rs.65 crores for the acquisition. INX Media, founded by Indrani Mukherjea, had initially seen investment participation from many respectable investors – like Kotak Mahindra Capital, Temasek, New Vernon Private Equity, New Silk Route and Srei. Unfortunately, INX’s overall media business now has accumulated losses that are estimated to cross Rs.8 billion by the end of the current fiscal year. The firm is said to owe around Rs.1.3 billion to its creditors. One reason Zee might be attempting to buy 9X instead of launching its own GEC could be that recently, the government had stopped processing new license applications citing infrastructure scarcity. Zee may re-launch 9X as its second GEC, given that as on date, both STAR and Sony have their secondary GECs – STAR One and SAB – running full time. But given that Zee’s earlier attempt at launching Zee Next was not so successful as the channel was shut down within a year of its launch, are there any lessons for Zee out here? One advantage is that with 9X comes the existing infrastructure, which is already in place at 9X. At the same time, the book losses of 9X can be easily converted into taxation advantages for Zee. Anand Shah, Analyst, Angel Broking, tells 4Ps B&M, “Any company which makes a lot of profit has to pay a fair amount of tax as well. The tax benefit is being perceived as the key motive of the deal. The deal may just be yet another attempt to emerge stronger amongst a number of general entertainment broadcasters who are in cut throat competition for eyeballs.” The zeal is evidently unmistakable... Amir MoinFor more articles, Click on IIPM Article.Source : IIPM Editorial, 2010. An Initiative of IIPM, Malay Chaudhuri and Arindam chaudhuri ( Renowned Management Guru and Economist). For More IIPM Info, Visit below mentioned IIPM articles.

IIPM B-School Detail

IIPM makes business education truly global

IIPM’s Management Consulting Arm - Planman Consulting

Arindam Chaudhuri (IIPM Dean) – ‘Every human being is a diamond’

Arindam Chaudhuri – Everything is not in our hands

Planman Technologies – IT Solutions at your finger tips

Planman Consulting

Arindam Chaudhuri's Portfolio - he is at his candid best by Society Magazine

IIPM ranked No 1 B-School in India

domain-b.com : IIPM ranked ahead of IIMs

IIPM: Management Education India

Prof. Rajita Chaudhuri's Website---------------------------------------------------------------------------------------------------------------

The most talked about ad property in recent times has, surprisingly, attracted drastically mixed reactions in its second edition, which played out with full force in the recently concluded IPL. Who’s winning? 4Ps B&M investigates

Recreation of real-life situations with rib-tickling and sassy humour through totally side-splitting comical commercials – and all through creatures that a couple of years back you wouldn’t have cared two hoots about! Whether you love them or hate them, you simply can’t ignore them. Zoozoos have in all their glory conquered their rightful land in the ad-empire! Those adorable, charming, alien creatures unleashed by Vodaphone last year, courtesy Ogilvy, who took the viewing public by storm through their sheer ingenuity, freshness, quirkiness and that rare specialty Ogilvy has mastered – a magical fusion of surprise and delight! Yes, we do adore the Zoozoos, but the point is – did the second Zoozoo ads installment inspire, attract or generate the same degree of joy, enthusiasm, wows and appreciation as the first … or was it a predictable and to an extent repetitive overkill – that was seen for the humour surely, but did not cut any deep creative ice with the consumers? The question – led by 29 TVCs that blitzed the IPL viewer across 45 days – surely doesn’t have a predictable answer, as we realised when we flipped through industry responses...

“Of course, it wasn’t the same and frequently got boring and brain dead as hell!” That is the surprising reply of Delhi-based DD director Ananya Banerjee. She confesses she loved last year’s package but this time “it was getting on my nerves! The frequency was maddening and god, some of them were downright dumb and corny!” But godfather Alyque Padamsee believes that anyone who fails to be charmed by these amazing creatures has no right to be “certified sane!” He confesses to be a total fan of the little fellas and congratulates Vodaphone, the agency and the film production company for pulling off such a fabulous effort. “I freeze the remote the moment the delightful Zoozoo ads hit the screen! For me, they have the same charm and endearing quality as the Fevicol ads. Are they boring because they play out the same theme? Not at all, and that’s because of the brilliant creative execution. I place them alongside the iconic Air India’s Maharaja, the Amul characters and Asian Paints Gattu. Kudos to the team!”

Subhash Goyal

Chairman, Stic Travel Group

From the moment we stepped aboard one of their mid-sized ships, we recognised that the Holland America Line was different. They sail with nearly one crew member for every two guests, providing gracious service; and it was a classic cruising. Their ships feature spacious wrap-around teak decks, which enabled us with never before panoramic views from abundant spacious private verandahs.

For most part of the year gone by, realtors harped over the affordable housing strategy to lure consumers. But builders now are now trying to lure buyers through theme-based dreams! Do they even stand a chance?Of he few structures that would be hard to miss while sauntering along Dubai’s Business Bay, the Boris Becker Business Tower, which is increasingly becoming an emerging commercial hub of the city, forms the key. The 19-storey tower standing tall above the water-level, is the third and final offering of the ‘Sports Legends Trilogy’ built by Germany’s ACI Real Estate Developer, which has also built the Niki Lauda Twin Tower and Michael Schumacher Business Avenue. Moving beyond the city of gold, even countries like UK and Jordon have developed a state of the art Media City to promote the media industry of their respective countries. In India too, the development of Cyberabad in the city of Hyderabad, marks the coming together of several Fortune 500 companies from the IT/ITeS sectors. But these aforementioned projects are all commercial, relatively easy to sell and more so, when you have a theme associated with the structures. And while this trend of marketing commercial real estate projects (either by associating a personality or attaching a theme with the project) has for long been in vogue, the ‘theme’ proposition is steamrolling itself into the residential property space in India. Apparently, this would help real estate developers boost sales by spamming the nouveau rich segment. Umm, does this even work?

The success of Bollywood superstar Shah Rukh Khan’s maiden real estate venture – Shah Rukh Khan Boulevard – in Dubai is an example of how aspirational the global consumer has become when it comes to buying a house. But then, isn’t the Indian customer a beast with an undefined nature? With the commercial real estate still growing at a sluggish pace in the Indian market, all hopes of most of the developers are pinned on their residential projects. Currently, the market scenario is such that around 40% of the property being purchased is for investment purposes and the remaining 60% is bought for actual residential use. To that extent, developing theme-based housing projects does seem – on the face of it – to be a high risk high return proposition.

But Vivek Mittal, CEO, Realty Stocks, disagrees with us, “The last 18-24 months saw a huge dip in the realty sector, with both residential and commercial space suffering from a lack of demand. Affordable housing helped the realtors gain some ground by selling houses in the range of Rs.20-30 lakh. However, it is time that realtors offer more than just affordable houses to their consumers. Launching theme-based houses is a step in that direction.” It is accepted that with more and more educated consumers coming into the picture, there is a dire need for proper marketing of the projects. But wouldn’t theme-based projects end up being too costly for the consumer? For more articles, Click on IIPM Article.Source : IIPM Editorial, 2010. An Initiative of IIPM, Malay Chaudhuri and Arindam chaudhuri ( Renowned Management Guru and Economist). For More IIPM Info, Visit below mentioned IIPM articles.

IIPM B-School Detail

IIPM makes business education truly global

IIPM’s Management Consulting Arm - Planman Consulting

Arindam Chaudhuri (IIPM Dean) – ‘Every human being is a diamond’

Arindam Chaudhuri – Everything is not in our hands

Planman Technologies – IT Solutions at your finger tips

Planman Consulting

Arindam Chaudhuri's Portfolio - he is at his candid best by Society Magazine

IIPM ranked No 1 B-School in India

domain-b.com : IIPM ranked ahead of IIMs

IIPM: Management Education India

Prof. Rajita Chaudhuri's Website---------------------------------------------------------------------------------------------------------------

|

RSS Feed

RSS Feed